Best Travel Credit Cards of 2020

By: Money.com

Even though the travel industry is currently at a virtual standstill, now may be a good time to look into travel credit cards. Not being able to travel shouldn’t be a reason to avoid taking advantage of some of the great benefits credit card companies are still offering.

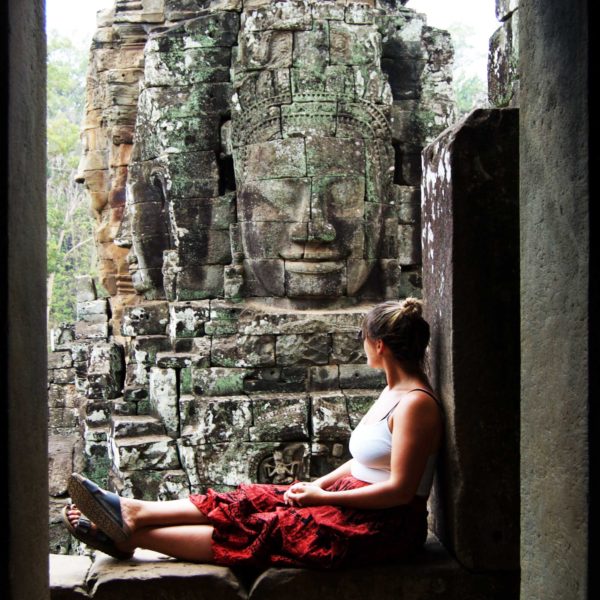

She’s Going founder, Samantha maximized her Credit Card opportunities while staging 26 AirBnb units, got 3x point on every dollar spent, then flew around the world for free! So, she was thrilled to have Money.com share our list of Best Travel Credit Cards of 2020.

Using your points earned towards free flight is the of the an amazing perk! However, what many people fail to realize are additional benefits like skipping through airport security lines, access to exclusive airport lounges, free in-flight Wi-Fi etc.

Below, you will find a list of the best travel credit cards for 2020. The MONEY team studied and compared hundreds of travel credit cards taking into account earning rates, sign-up bonuses, travel benefits, and fees.

Travel Credit Cards and the COVID-19 Pandemic

Credit card companies such as Chase and American Express have begun to extend the eligible purchase periods giving their customers additional time to earn their signup bonuses.

Some companies are now providing additional bonus points for purchases done due to the pandemic. Examples include streaming services, food and grocery delivery.

It is important for cardholders to check in with their credit card companies to learn which non-travel purchases qualify for bonus points.

This list of the best travel credit cards can help you figure out which card might work best for your travel goals and spending style. Before you signing up for a travel credit card, you should learn everything you can about their rewards programs and travel benefits — Reading the fine print is heavily suggested.

The following reviews can help you figure out which travel credit card might be right for you:

Chase Sapphire Reserve – Best Travel Credit Card Overall

The Chase Sapphire Reserve is the best travel credit card travelers can get. Despite having a higher annual fee of $550, the perks and benefits you receive far outweigh the cost of the annual fee.

Cardholders will earn 50,000 points when you spend $4,000 or more within the first three months after opening it. Chase also lets you earn 3x points on dining and travel and 1x points on other purchases.

Travelers with a Chase Sapphire Reserve card get access to more than 1,300 airport lounges around the world plus a TSA Precheck or Global Entry membership.

Additionally, you get a $300 annual travel credit that applies to any travel purchase you make with the card automatically.

Chase Sapphire Reserve cardholders will receive complementary Lyft Pink membership, priority airport pick-up and three free 30-minute bike or scooter rides per month. Plus, Reserve cardholders automatically earn 10x total points on Lyft purchases.

Reserve cardholders can now receive up to $120 in statement credits when ordering on DoorDash. Members also receive a subscription to DashPass with unlimited $0 delivery fees on orders of $12 or more.

Transfer points 1:1 to Chase airline and hotel partners. And when you book through the Chase portal, points are worth 50% more. If you want to redeem your points on non-travel options, you can do so for gift cards, merchandise, experiences, and more.

Chase Sapphire Preferred: Best Budget Credit Card for Travel

The Chase Sapphire Preferred is the best card for travelers on a budget. Cardmembers are given 60,000 points if they spend $4,000 or more within the first three months after opening the account. With an annual fee of $95, the first-year benefits are worth trying out.

You’ll also earn 2x points on travel and dining and 1x points on other purchases; and earn 5x points on purchases made with Lyft.

When you cash out your points for travel, if you do so through the Chase portal, you will get 25% more value. Sapphire Preferred points can also be used for 1:1 transfers to Chase airline and hotel partners.

If you decide not to travel, you can redeem points for cash back, statement credits, gift cards, and more.

Additional benefits include:

- No foreign transaction fees

- Trip cancellation/interruption insurance

- Baggage delay coverage

- Primary auto rental coverage

- Purchase protection

- Extended warranties on products purchased with the card

The Platinum Card from American Express: Best Travel Perks

With a welcome bonus of 60,000 points when you spend $5,000 within the first three months, the Platinum Card from American Express is an attractive prospect for many travelers.

Once you sign up and receive your card, you’ll earn 5x points on flights booked direct or through AmexTravel.com, 5x points on prepaid hotels booked through AmexTravel.com, and 1x points on all other purchases.

Similar to Chase’s travel credit cards, the Platinum Card from American Express also lets you transfer points to a variety of travel partners. You can use points to book flights, hotels, and more through AmexTravel.com and can also redeem rewards for statement credits, gift cards, or merchandise, although redemption values vary.

When it comes to travel benefits, the Platinum Card from American Express has the most comprehensive airport lounge benefits available:

- A $200 annual airline credit

- Up to $200 in Uber credits per year

- Hilton Honors Gold Status, Marriott Bonvoy Gold Status, and more.

Capital One Venture Rewards Credit Card: Best Flat-Rate Travel Rewards

With the Capital One Venture Rewards Credit Card you earn 50,000 miles after spending $3,000 within the first three months of opening the account. You will also earn 2x miles for each additional dollar you spend.

It is important to highlight that these are not airline miles. Instead, these “miles” are considered flexible travel credit that members can use for flights, hotels, or campground stays. You may also transfer your miles to a few international airline partners such as Air Canada and Aeromexico.

This card has a $95 annual fee that is waved during the first year of obtaining it. One perk cardholders get is a $100 credit towards Global Entry or TSA Precheck.

Additional benefits include:

- No foreign transaction fees

- Auto rental coverage

- Extended warrantied

- Travel accident insurance

Wells Fargo Propel American Express Card: Best with No Annual Fee

This card is a perfect match for those looking for a no fee travel credit card. Cardholders will earn 3x points on dining, gas, rideshares, streaming services, flights, transit, plus 1x points on all other purchases. The card includes a sign-up bonus of 20,000 points when members spend $1,000 within three months of obtaining the card.

The card does not have a limit to the reward you can earn. You may redeem your points with the card’s Go Far Rewards program. You can also cash in your points for statement credits and gift cards.

Additional benefits include:

- Cell phone insurance

- Lost luggage reimbursement

- Extended warranties on eligible items purchased with your card

What You Need to Know About Travel Credit Cards

Having a travel credit card can allow you to have a more enjoyable and affordable travel experience, which means planning is key.

Here are some tips to help you enjoy the benefits of owning a travel credit card.

Watch out for High APRs

Having generous benefits for your travels is great, but don’t let that cloud your judgement. Stay within your budget. If you don’t, the cost of racking up long-term debt may outweigh the value of any “free flight” you earn.

With this in mind, only use your card if you can pay the balance in full before the next cycle begins. Otherwise, you may need to give up on the rewards and go with a credit card with a much lower APR instead.

Annual fees shouldn’t scare you off

Even though our top travel credit cards charge high annual fees, they can be justified if you take advantage of your credit card’s perks and benefits.

Let’s use Chase Sapphire Reserve’s $550 annual fee as an example. When you receive this card, you automatically get a $300 annual travel credit right away; a $100 credit towards Global Entry or TSA Precheck; airports lounge membership worth around $429 if paid for in cash. This sums to $829 in value. Plus, you still have to take into account the sign-up bonus and the extra points you may earn making purchases.

When you think of it this way, the annual fees some credit cards charge start to make sense.

Consider pairing more than one card

To maximize your spending, you may want to consider combining credit cards to get the most out of your rewards.

For example, you can combine the Chase Sapphire Reserve’s 3x points on travel and dining with the Chase Freedom Unlimited’s flat 1.5% back on non-bonus spending.

The good thing here is that Chase allows card holders to pool all their points in one account for redemptions. This means the cardholder’s Chase Sapphire Reserve account gets 50% more travel through the portal.

The Bottom Line

If you travel somewhat frequently, considering a travel credit card may be worth your time. There are a variety of different cards, offerings, reward usage, and reward perks, so be sure to do your research. Because who doesn’t like getting rewards for everyday purchases?